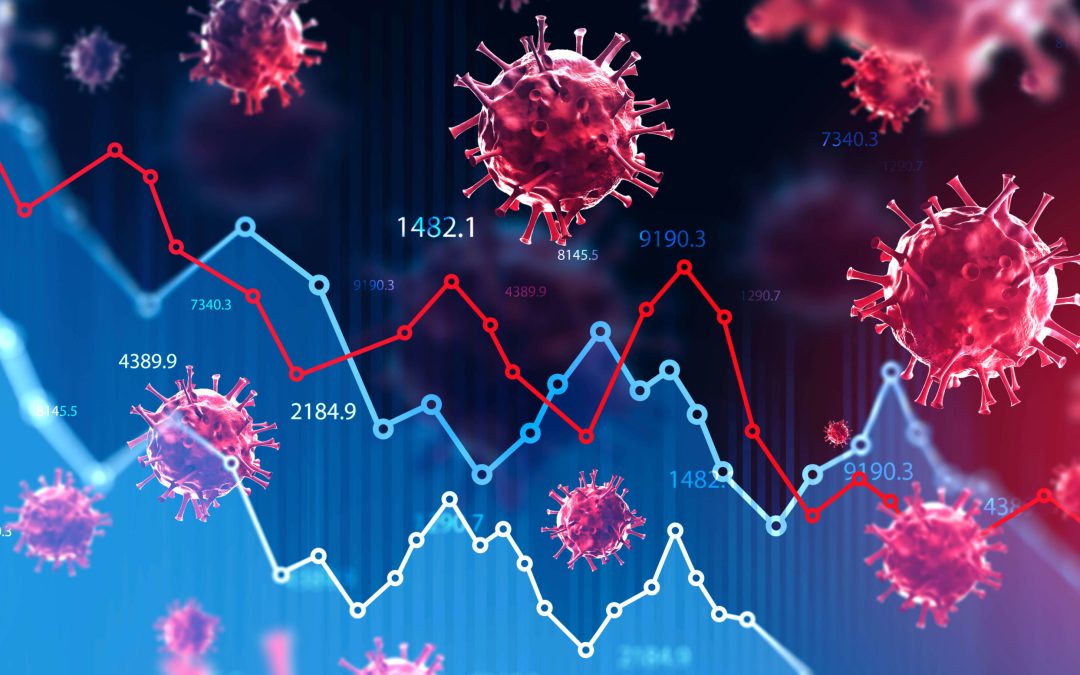

Last week was a reminder of the value of diversification. A bank that focused on a niche portion of the economy succumbed to “unexpected” events. The fallout took down the investors, but not the depositors. This is a serious issue for those directly impacted and a...