Our Insights

Financial Enhancement Group (FEG) is a wealth management firm based in Central Indiana with offices in Indianapolis, Lafayette, Anderson, and Rensselaer, as well as Bozeman, MT and Sonoma County, CA This page is updated with insightful posts on tax strategies, retirement planning, investing, and the economy. We invite you to read our articles to stay informed on the current and changing financial climate and share this information with your friends and family.

Diversification Defined

Last week was a reminder of the value of diversification. A bank that focused on a niche portion of the economy succumbed to “unexpected” events. The fallout took down the investors, but not the depositors. This is a serious issue for those directly impacted and a...

The Taxes Are Coming

As Benjamin Franklin once said, “. . . in this world, nothing is certain except death and taxes.” For good reason, few people like to talk about either of these topics. Nonetheless, in this article, I will focus on the latter, taxes. In retirement, taxes are coming...

Success in Retirement

Success in retirement requires maintaining the standard of living you are accustomed to living as long as you are alive. Granted, that standard will change as you age, but the trick is maintaining the opportunity for making financial decisions at retirement age with...

How Much Is Enough?

You can do three things with the money you make: spend it, save or invest it, or give it away. People who are wise with money tend to do all three and stick to a ratio that makes sense for their situation. The percentages you commit to each category can vary...

Five Things to Focus on Before Retirement

Life is filled with many tough choices and important decisions. Where do I attend college? Who am I going to marry? What am I going to do for my career? What's for dinner tonight? All these questions have consequences once the decision is made. One of the most...

Have The Discussion

What a difference it makes being prepared! Laying your clothes out the night before, planning your meals and making a list for the grocery, studying for an exam 1-2 weeks in advance, studying game film for your upcoming opponent; these are all simple examples of the...

How did you meet?

Relationships exist between two or more people, but we also develop relationships with things. My wife would suggest I have a tumultuous relationship with my golf game. Others may find themselves in relationships with investments statements. How we mentally frame and...

Recession?

Two consecutive quarters of negative GDP (Gross Domestic Product) – this has been a reliable rule of thumb to accurately determine if a recession has occurred. The National Bureau of Economic Research (NBER) uses more complex formulas to officially declare a...

What to Consider Before the Unexpected Occurs

Imagine for a moment you are on your way home from the store, and a dog jumps out in front of you. In a moment of surprise and quick reaction, you do your best to avoid the dog; however, you lose control of your vehicle and hit a tree. Thankfully, you survived the...

529: More than Just College Savings

In recent days, Congress passed a $1.7 trillion spending bill. Like most spending bills that are passed, many things are put into the bill that no one can decipher. However, within the spending bill the SECURE Act 2.0 was passed, allowing eligible families with 529...

Secure Act 2.0 Changes for 2023

Happy new year to you and yours. As you were preparing for the Holidays, Congress was working on passing the SECURE Act 2.0. The original Setting Every Community Up for Retirement Enhancement Act, passed in December 2019 and brought several changes to how we approach...

Beginning Again

Starting over and beginning again contain similarities in nature, but they are different. Starting over is when we recognize we could have done things differently in previous years and are looking to improve our focus in the upcoming year. Beginning again is...

Not the First, Won’t be the Last

Merry Christmas! We are approaching the end of another calendar year, and it has not been an easy one for those with investments. Investors have been reminded that one thing is true: annual investment growth is not guaranteed. 2022 has been a drawn out and long...

How Much Money Will I Need to Retire?

Imagine for a moment that your working career is coming to an end, and retirement is on the horizon. What does that look like for you? Are you going to travel to exotic destinations, live in a golf course community, spend more time with the grandkids, volunteer in...

Ambidextrous In A Changing Environment

In 2004, a Harvard Business Review article argued that ambidextrous leadership was crucial to long-term business success. Ambidextrous was defined as a business that exploited existing market opportunities, displayed operational excellence, and mandated executional...

Ripples vs. Waves

During the summer Olympics, millions of people watch the best divers in the world perform amazing acrobatic feats while falling with great speed toward a pool of water. One of the criteria for achieving a good score is based on how the diver enters the water – the...

Ways to maximize your year-end giving

As 2022 is winding down to a close, Thanksgiving and the holiday season is now upon us. I hope that you have many things to be thankful for this year; I know I sure do. I am grateful for my family, friends, career, co-workers, health, and families that we are blessed...

What the FTX?

Is it just me or does “crypto” anything remind you of a funeral? Cryptocurrency derives its name because it uses encryption to verify transactions. Per Wikipedia: “A cryptocurrency, crypto-currency, or crypto is a digital currency designed to work as a medium of...

Perspective Matters

Four thousand one hundred sixty weeks. This is how many weeks you would have if you lived 80 years. I do not know how that makes you feel, but it forces me to have a new perspective on the fleeting amount of time we have on this earth. Carpe Diem! It is easy to get...

Reading the Scales

My body weight varies daily by small percentages, but over time the change can be substantial. Because, as a human, I am fixated on the reason why something happened, I blame or credit the result on nutrition, exercise, and various other conditions. The only thing I...

IRS Announce Changes for the 2023 Tax Year

Fall is my favorite time of the year, and it is here. The leaves have begun to change, the temperatures are starting to cool off, and we are in the middle of college football season. Just like the weather has begun to change, the IRS has made changes that will affect...

Control the “Controllables”

Imagine a table filled with desserts – cookies, Danishes, doughnuts, pies, and brownies. Now imagine this table being in the kitchen at work versus the kitchen at home. Are you more likely to indulge in the Danish if it is at work or at home? This is an example of how...

Did you know you have an estate plan?

“We’ve never gotten around to it,” “We need to do that,” “That is something we have discussed, but it always gets put off.” These are common responses I hear from families when I ask if they have their estate documents created or updated. It is a common observation...

Tools and Techniques

Rarely do we question what might be wrong when things appear to be working. The inverse is also true: we seldom ask what works when things appear in disarray. This column will be a two-part article addressing investment tools of the trade and then techniques for how...

Buffer Your Budget

Buffer Your Budget If you were the Chief Financial Officer of a business, would you manage the company budget the same way you manage your household budget? I believe some of you would, but odds are most of you would not. I am not shaming any of you for how you handle...

The Culprit

Confidence comes from a belief in understanding a situation, even if the conclusion or “reason why” is inaccurate. Placing a name to the culprit or the potential cause of a condition generates more ease internally. It’s inflation, consumer debt, student loans, energy...

Travel Alert

When would you want to know if you were heading on a road trip and something ahead created a challenge? Your answer likely depends upon the severity of the issue and the potential alternatives. What about significant issues at the moment that will be resolved by the...

Navigating Tough Estate Decisions

Getting understanding and clarification from the deceased is somewhat tricky. For more than 25 years, I have been involved in many estate planning situations with varying outcomes. Inevitably, “peaceful and easy” situations shared two common denominators:...

Join us in congratulating Daren Hardesty, Senior Advisor, on passing his CFP® certification exam!

The Certified Financial Planner certification (CFP®) is a formal recognition of expertise in the areas of financial planning, taxes, insurance, estate planning, and retirement. The Financial Enhancement Group is honored to announce that Daren Hardesty, Senior Advisor,...

Not Your Father’s Housing Market

For eight years, my wife and I raised our family in a house we bought together right before we were married in 2014. We quickly grew into a family of five plus one dog. We loved our home, but we were filling up the small amount of square footage, so we decided it was...

Your Notice of Change

The US legislature is required to raise revenue for bridges, armies, and social safety nets. The budget changes and the need for more income seem obvious. The tax code creates a rule book attempting to uncover the necessary revenue to run our country. Bear in mind...

Is higher inflation a cause for concern?

Your Retirement Playbook with Joe Clark, CFP. In this segment, we will cover: Is higher inflation a cause for concern? Unfortunately, inflation impacts your retirement dreams. Inflation is like high blood pressure; whether you know you have it or not, it can still...

Creating your Letter of Intention – Legacy Planning and Estate Planning

Your Retirement Playbook with Joe Clark, CFP. In this segment, we will cover: Creating your Letter of Intention - Legacy Planning and Estate Planning It is difficult to speak when you are no longer here. A letter of intention gives your family the easiest opportunity...

Life Insurance Basics: What you need to know.

Your Retirement Playbook with Joe Clark, CFP. In this segment, we will cover Life Insurance Basics: What you need to know. Is your life insurance policy current? They call it permanent insurance because you are supposed to die with it; however, the average person ends...

Do your Retirement accounts need to be rebalanced?

Your Retirement Playbook with Joe Clark, CFP. Do your Retirement accounts need to be rebalanced? Rebalancing retirement accounts means selling from what did well and purchasing what did poorly the quarter before. We will discuss if you should and how to go about it in...

What are you trading for convenience?

“Everyone pays the price. Either you pay the price of discipline today or the price of regret later on.” That was one of the first business quotations I took to heart years ago and came from the legendary Zig Ziglar. The concept is true in saving money today versus...

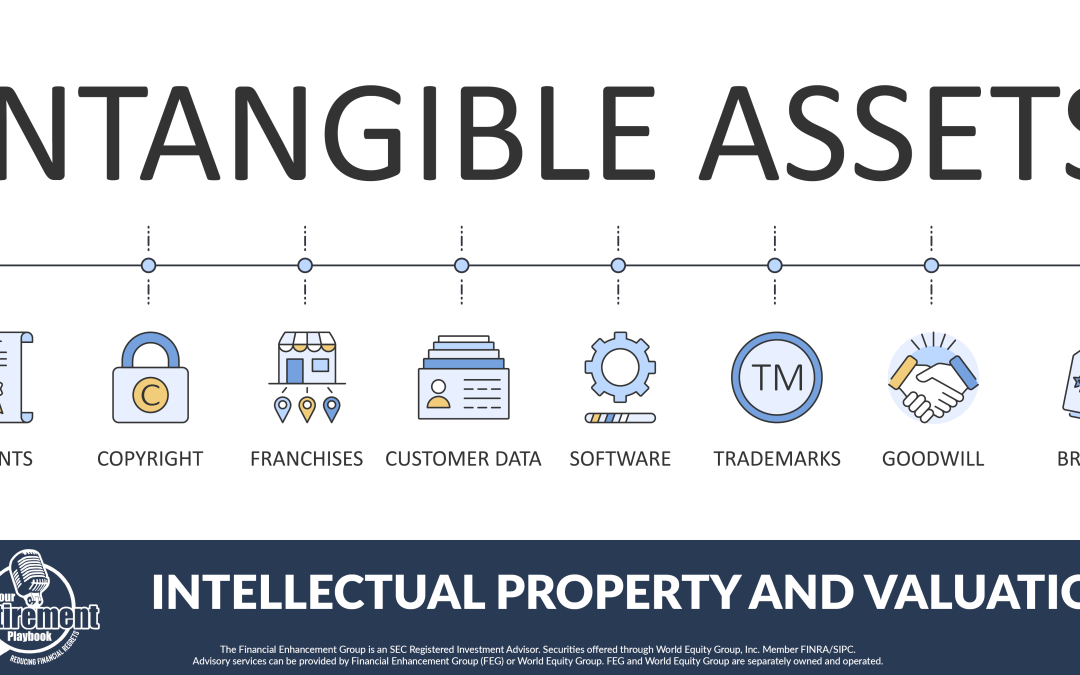

Intellectual Property and Valuation – 2042

Your Retirement Playbook with Joe Clark, CFP. In this segment, we will cover: How do I value my intellectual property? What exactly is an intangible asset, and how have things changed over time? Your Retirement Playbook” is an educational program designed to help...

Changes Along Your Financial Journey – 2041

Your Retirement Playbook with Joe Clark, CFP. In this segment, we will cover: There are several ways to get to Florida, but you can’t switch along the way! The goal is to get where you want to go, but there WILL be interruptions along the way, and we need to plan for...

Reverse rollover pitfalls and possibilities – 2043

Your Retirement Playbook with Joe Clark, CFP. In this segment, we will cover: Moving money from a 401K into an IRA makes sense, but sometimes you have to reverse your decision. Your Retirement Playbook” is an educational program designed to help listeners better...

72(t) just say NO tax planning show – 2044

Your Retirement Playbook with Joe Clark, CFP. In this segment, we will cover: 72(t) allows you to get money out of an IRA before you turn 59.5, but it comes with serious stipulations and consequences; proceed with caution!! Your Retirement Playbook” is an educational...

What To Consider When Transferring Assets

Investments have varying characteristics. The most essential issues are volatility, taxation, and liquidity. Occasionally, assets have to be divided amongst children and spouses in the case of divorce. Picking and choosing assets to be exchanged or delivered to a...

Fickle Fundamentals and Intangible Assets

The stock exchanges report the price that a willing buyer and willing seller agree upon for a share of a publicly traded stock. In most cases, the buyer and the seller are unaware of each other's identities, and the desire to buy or sell can stem from many scenarios....

Avoiding Investment Mistakes 2036

Your Retirement Playbook with Joe Clark, CFP. In this segment, we will cover: We think things are crucial to consider in your financial journey. You get one shot at retirement, and we are here to help you reduce financial regrets. Your Retirement Playbook” is an...

Can I give money without being taxed 2038

Your Retirement Playbook with Joe Clark, CFP. In this segment, we will cover: In this segment of Your Retirement Playbook, we will discuss how to use and gift your money in the best way. We want to help you be a better giver, not a bigger giver. Your Retirement...

How to create a tax plan for your retirement 2037

Your Retirement Playbook with Joe Clark, CFP. In this segment, we will cover: What does it look like when you begin to transfer from your working life to your life after work? You need to plan for how your taxes change and how you can be proactive. Your Retirement...

Retirement strategies during a volatile market 2039

Your Retirement Playbook with Joe Clark, CFP. In this segment, we will cover: You have done a great job saving for your life after work, but what happens when it is time to take money out of your accounts? Your Retirement Playbook” is an educational program designed...

Avoiding Tax and Investing Mistakes – 2040

Your Retirement Playbook with Joe Clark, CFP. In this segment, we will cover: We have Your Retirement Playbook program to help people reduce financial regrets, and in this episode, we will talk about four things you need on your radar right now. Your Retirement...

Trusting Your Advisor

Character trust and competency trust are separate issues. Character trust is derived from believing a person has your best interest at heart and liking them. Competency trust exists when you believe they can do the task expected and required to meet stated objectives....

Fear – there’s a financial plan for that

During his inauguration speech, Franklin D. Roosevelt left us with these famous words, "So, first of all, let me assert my firm belief that the only thing we have to fear is fear itself – nameless, unreasoning, unjustified terror which paralyzes needed efforts to...

I inherited $500,000; what should I do?

Your Retirement Playbook with Joe Clark, CFP. In this segment we will cover: On this segment of Your Retirement Playbook, we will explore a cautionary inheritance tale so that you don't make the same mistake! Your Retirement Playbook” is an educational program...

Understanding Tax Diversification Strategies 2029

Your Retirement Playbook with Joe Clark, CFP. In this segment we will cover: When you have an extra dollar, where should you put it? Do you have a checklist or process on how to make that decision? Join us as we break it down! Your Retirement Playbook” is an...

How do Inherited IRA’s work? 2027

Your Retirement Playbook with Joe Clark, CFP. In this segment we will cover: The art of childhood is knowing what to tell your parents and when! Join us on "Your Retirement Playbook" as we discuss what to think about when you are getting an inheritance and why you...

Retirement Wrecks

Separating from the workforce and living off your accumulated savings requires an organized and dedicated strategy. The new life of distributing your assets generates natural emotional responses. You have diligently saved and accumulated savings for the last 30-40...

What Hazards Get in the Way of a Successful Retirement? – 2019

Your Retirement Playbook with Joe Clark, CFP. In this segment we will cover: What can possibly go wrong?! The things that happen on your financial journey are similar to the struggles you will face in golf. Let's talk about your financial hazards. Your Retirement...

Does the Economic Condition Matter in Your Portfolio? 2018

Your Retirement Playbook with Joe Clark, CFP. In this segment we will cover: What economic condition are we in today? Sure, the economic condition matters to help you decide what you need to do next in your financial planning, but what do I need to take into...

Where Should I Invest? 2017

Your Retirement Playbook with Joe Clark, CFP. In this segment we will cover: How do you know where "A" dollars and "B" should be invested? When faced with a buffet of options, which one should you choose first? In this segment of Your Retirement Playbook, we will...

Golf Is A Lot Like Financial Planning – 2016

Your Retirement Playbook with Joe Clark, CFP. In this segment we will cover: Golf is a lot like financial planning. Life is a series of decisions based on shots in the current conditions. Financial planning is a series of decisions based on shots and conditions. Golf...

Finding Income in a Down Market – 2023

Your Retirement Playbook with Joe Clark, CFP. In this segment we will cover: Should you use additional income streams like social security, home equity, or sell other assets to provide income in uncertain times? We break it down on Your Retirement Playbook. Your...

Drawdowns Are Real – 2024

Your Retirement Playbook with Joe Clark, CFP. In this segment we will cover: How will drawdown impact your chances for success in retirement? You need to hear this episode of Your Retirement Playbook! Your Retirement Playbook” is an educational program designed to...

Drawdowns Are Real – 2024

Your Retirement Playbook with Joe Clark, CFP. In this segment we will cover: How will drawdown impact your chances for success in retirement? You need to hear this episode of Your Retirement Playbook! Your Retirement Playbook” is an educational program designed to...

The Most Dangerous Retirement Mistake – 2022

Your Retirement Playbook with Joe Clark, CFP. In this segment we will cover: Success is never dependent upon one thing, but failure can be. What does a failed retirement journey look like? Learn more on this episode of Your Retirement Playbook. Your Retirement...

Retirement Mistakes – 2021

Your Retirement Playbook with Joe Clark, CFP. In this segment we will cover: Whether you are a new retiree or a seasoned one, we often have the same concerns. The best way to avoid retirement mistakes often comes from having the best questions formulated. My advice...

How Did You Meet Your Investments? 2008

Your Retirement Playbook with Joe Clark, CFP. In this segment we will cover: How did that wind up in your portfolio? I've been married for 34 years, and when we meet new couples, they always ask one question, "How did you meet"?! In this segment, we will get into the...

Should You Cancel Your Life Insurance Policy? 2012

Your Retirement Playbook with Joe Clark, CFP. In this segment we will cover: Should you cancel your life insurance policy? There are many things you consider when you look at Life Insurance. Should you keep paying that premium or cancel it? We will discuss the...

Finding Fair Value

The bell rings, and the excitement begins at 9:00 EST Monday through Friday most weeks. Wall Street opens up for trading, and thousands of companies are available for purchase as stock shares. Willing buyers and sellers reach a price for each of those stocks second by...

A Bear Market, Now What?

If you are like most investors, you carry a few scars from past bear market experiences. And you may be asking the following questions, “What happened to get us here, and how do we make it through?” Answering these questions logically is the easy part. Not making...

Basic Instructions and Concepts to Follow in Your Retirement Playbook 2004

In this segment we will cover: You know there are a lot of different ways to skin a cat, or so they tell me- I've never tried but when it comes to retirement, or what we call Your Life After Work, there are many different ways to get it done. There are some basic...

Avoiding Bad Decisions is the Key To Success 2004

Your Retirement Playbook with Joe Clark, CFP. In this segment we will cover: Avoiding bad decisions, that's the key to success! We have to break down our thinking and what our processes are to make a decision. It can not be based on reaction as opposed to responding...

What is Your Financial Dopamine 2005

Your Retirement Playbook with Joe Clark, CFP. In this segment we will cover: Get out of the penalty box! You know I hate rules (or are the guidelines or the suggestions?). When I look at most people's financial plans, other people's decisions were actually made,...

Get out of the Investment Penalty Box 2002

Your Retirement Playbook with Joe Clark, CFP. In this segment we will cover: Get out of the penalty box! You know I hate rules (or are the guidelines or the suggestions?). When I look at most people's financial plans, other people's decisions were actually made,...

What in the World is a Tax Bomb?! 2003

Your Retirement Playbook with Joe Clark, CFP. In this segment we will cover: What in the world is a tax bomb?! Ed Slott's retirement Tax Bomb. I've been a part of Ed Slott's organization for the last 18 years (hard for me to believe), where we study taxes. This...

What is Your Next Step? 2001

Your Retirement Playbook with Joe Clark, CFP. In this segment we will cover: You know there's an old expression in the business world that you can either work in the business (that's looking at the day-to-day things) or work on the business, and that is where you will...

Where’s Waldo? – Our new show title Your Retirement Playbook – 2000

Your Retirement Playbook with Joe Clark, CFP. In this segment we will cover: Hey, where's Waldo?! what happened to Consider This Program? In the last seven months, I have taken time off from creating educational content, just resting and thinking about the messages...

Considerations Before You Retire

Who doesn’t want to retire? More people than you may think, including myself. The rationale for continuing to work comes from the obvious “I love what I do” to “What would I do?” Our experience would suggest there is also a large contingency that is simply unwilling...

Don’t Leave Your Life or Investments on Autopilot

My first airplane ride was in 1988. I remember the anxiety, but it was thrilling! My new bride and I went through security and boarding, got on the plane, popped the Dramamine, and held hands during takeoff. The crew efficiently served beverages, and 40 minutes later,...