Our Insights

Financial Enhancement Group (FEG) is a wealth management firm based in Central Indiana with offices in Indianapolis, Lafayette, Anderson, and Rensselaer, as well as Bozeman, MT and Sonoma County, CA This page is updated with insightful posts on tax strategies, retirement planning, investing, and the economy. We invite you to read our articles to stay informed on the current and changing financial climate and share this information with your friends and family.

Stock Market Turbulence… Is It Over?

Investors can find multiple reasons to be concerned about the current state of U.S. equity markets, including the current season. Summer is historically a poor performing time relative to the November through April period. Additionally, the Federal Reserve is on a...

What are the 5-year rules for Roth and how to use them in retirement 1415

Consider This Program with Jamie Burton and Grant Soliven, AIF. In this segment we will cover: With rising long-term care costs in the US, it is no wonder that this is a regular topic of discussion. And when it comes to the financial dimension of long-term care, truly...

What are the 5-year rules for Roth and how to use them in retirement 1415

Consider This Program with Jamie Burton and Grant Soliven, AIF. In this segment we will cover: In the world of retirement accounts, Roth IRAs are the favored child. What’s not to love about totally tax-free growth on your retirement savings? Find out all you need to...

Bonds and pain… 22’s Rough Fixed Income Journey

The start of the year has continued the already rough track for fixed income. Rising interest rates and elevated inflation shake the safety net that bonds have traditionally provided. And the pain becomes particularly unnerving for investors when the equity market...

Portfolio reconstruction #1410

Consider This Program with Jamie Burton and Grant Soliven, AIF. In this segment we will cover: A well-diversified portfolio is vital to any investor’s success. As an individual investor, you need to make sure your asset allocation best conforms to your personal...

The Pros And Cons Within Your Pension – #1411

Consider This Program with Jamie Burton and Grant Soliven, AIF. In this segment we will cover: If you are blessed enough to still have a pension, you will come to know that you have options on how you can take the pension. Find out the pros and cons of the options...

Your Future with Aging Parents

For many, parents are the guiding lights of the first portion of our lives. Parents make sure we eat healthily, set us up for doctor appointments, and otherwise work to help us make the best decisions for a fulfilling life. As we age, though, so do they. And with...

Is it bad luck to purchase life insurance? 1149

Consider This Program with Jamie Burton and Grant Soliven, AIF. In this segment we will cover: When preparation meets planning, little luck is actually needed! Find out why planning the loss of a spouse is more than just a life insurance policy. Talking Points: 1....

Managing retirement takes a lot more than luck! 1148

Consider This Program with Jamie Burton and Grant Soliven, AIF. In this segment we will cover: When preparation meets planning, little luck is actually needed! On this episode of Consider This Program, we will talk about our Investment Playbook and several other...

An HSA Is More Valuable Than You Think

A loving mother is a blessing beyond words. I am a father of three young children, and I have the privilege of watching my wife love them more every day. As their dad, I am their loving protector, but their mom fills a place in their hearts that I cannot. You may be...

Worried about your parent’s health? How to start the tough conversations. 1406

Consider This Program with Jamie Burton and Grant Soliven, AIF. In this segment we will cover: For many, parents are the guiding lights of the first portion of our lives, They make sure we eat healthily, set us up for doctor and dentist appointments, and otherwise...

Healthcare – the mother of all retirement concerns. 1407

Consider This Program with Jamie Burton and Grant Soliven, AIF. In this segment we will cover: An unexpected or early retirement can bring a major headache of finding affordable health insurance until you turn 65 and can qualify for Medicare. If you find yourself in...

How much do I really need to retire?

Imagine for a moment that your working career is coming to an end and retirement is on the horizon. What does that look like for you? Are you going to travel to exotic destinations, live in a golf course community, spend more time with the grandkids, volunteer in...

Annuities – Annuity breakdown – the good, the bad, and the ugly 1413

Consider This Program with Jamie Burton and Daren Hardesty. In this segment we will cover: Are annuities good, bad, or ugly? It depends on your needs and the type of annuity. Find out all you need to know about annuities on Consider This Program. Schedule your...

Should you prepare for a bond market crash? 1412

Consider This Program with Jamie Burton and Daren Hardesty. In this segment we will cover: One of the most talked-about issues in the bond market is whether the U.S. Federal Reserve’s decision to raise short-term interest rates will trigger a dreaded bear market. The...

Is Your 401(k) Getting The Job Done?

Do retirement plans work for the American investor? One of the nation's largest investment firms, Vanguard, analyzed data from 4.7 million of their defined contribution plans and found through their "How America Saves 2021" report that the average 401(k) balance...

Seven Signs your retirement is OFF track! Episode 1403

Consider This Program with Aaron Rheaume, CKA, and Grant Soliven, AIF. In this segment we will cover: Coming to the end of your working career can be both exciting and terrifying. How are you going to replace your standard of living without a paycheck? Have you really...

7 Signs Your Retirement Is On-Track – New Checklist 1402

Consider This Program with Aaron Rheaume, CKA, and Grant Soliven, AIF. In this segment we will cover: Coming to the end of your working career can be both exciting and terrifying. How are you going to replace your standard of living without a paycheck? What are the 7...

Financial Trends You Should Fear in 2022

The financial world is evolving incredibly fast. A wild and emotional 2021 introduced meme-investing, new crypto assets, social media influencers, and a rabbit hole of many more innovations riddled with excitement, uncertainty, and fear. Unfortunately, the fear of...

Beware of Little Orphaned Assets

King Solomon famously wrote, "It is the little foxes that spoil the vine." In a secular moment, he might have written: "it is the little assets that spoil the estate plan." We uncover forgotten assets in a family's financial situation more often than not with...

How do gains and dividends affect your retirement? 1405

Consider This Program with Jamie Burton and Grant Soliven, AIF. In this segment we will cover: Investment Playbook Show Living off dividends in retirement is a dream shared by many investors, but in today’s environment marked by rising life expectancies, extremely low...

How To Begin Your Retirement Practice Year 1404

Consider This Program with Jamie Burton and Grant Soliven, AIF. In this segment we will cover: You understand that you need to replace a certain standard of living in retirement, but what does that look like? How do you know how much you really need? Find out what you...

The Taxes Are Coming! The Taxes Are Coming!

As Benjamin Franklin once said, “. . . in this world, nothing is certain except death and taxes.” For good reason, few people like to talk about either of these topics. Nonetheless, in this article, I will focus on the latter, taxes. In retirement, taxes are coming...

Are you missing opportunities in your 401(k)? – 1400

Consider This Program with Grant Soliven, AIF, and Aaron Rheaume, CKA. In this segment we will cover: Tax Planning Show An in-service, non-hardship distribution is a 401k option that not many are aware of. What other options are wrapped inside of your 401k? Are you...

Making the most of your 401(k) – 1401

Consider This Program with Aaron Rheaume, CKA and Grant Soliven, AIF In this segment we will cover: An in-service, non-hardship distribution is a 401k option that not many are aware of. What other options are wrapped inside of your 401k? Are you missing opportunities?...

Don’t Leave Your Investments to Lady Luck

Investing can be a very stressful endeavor, especially for us in or nearing retirement. Protecting the nest egg becomes very important as we near the time when distributions become a reality. Behavioral finance studies have repeatedly shown that many Americans would...

Umbrella Insurance

You work hard to ensure you’re covering all your financial bases. Homeowners insurance – check. Car insurance – check. Health insurance – check. And now someone is telling you your umbrella has to be insured? Despite the odd name, umbrella insurance covers more than...

Emotions and Your Financial Journey

Emotions play a role in many facets of life, and many of us experience several of them daily. You may experience pure joy and happiness when a child is born and anger when that child does something to upset you later in life. Everyday emotions play into our...

Inflation and the Stock Market – 1408

Consider This Program with Grant Soliven, AIF, and Andrew Thrasher, CMT. In this segment we will cover: Investors, the Federal Reserve, and businesses continuously monitor and worry about the level of inflation. Rising inflation can be harmful: input prices are...

Capital Gains – The Untold Story 1409

Consider This Program with Jamie Burton and Grant Soliven, AIF. In this segment we will cover: Everyone looks at income as dividends, however, the world changes and so does our approach to taking income from your portfolio. Join us on Consider This Program to figure...

Going with your gut can cost you big money. 1146

Consider This Program with Jamie Burton and Grant Soliven, AIF. In this segment we will cover: Making a gut call on investments may not be the wisest strategy. Having a process in place leads to more fruitful outcomes. Join us on Consider This Program as we break it...

Are you willing to gamble half a million dollars? 1147

Consider This Program with Jamie Burton and Grant Soliven, AIF. In this segment we will cover: Making the wrong call with your social security can cost you half a million dollars. Are you ready to take that gamble? On Consider This Program, we will discuss several...

The Inevitable Correction

My wife and I are safe drivers. I can confidently say this because we have not been pulled over for speeding since high school; we have only had one minor accident that involved backing into a car in our driveway (I won’t say which one of us did that), and we are...

Not Every Basket Is Created Equal

Knowing which basket to use is essential when engaging in activities like picking apples, or shopping at the grocery store. The same is true when evaluating your investment portfolio. The most common “baskets” used for investing today are mutual funds and their...

Do you have any defense in place to protect against a market decline? 1141

Consider This Program with Daren Hardesty and Grant Soliven, AIF. In this segment we will cover: Many people go into investing with an idea of how much they are going to make, but what happens when there is a drawdown in the market and you don't have a plan to protect...

Are you prepared for the tax tsunami? 1140

Consider This Program with Grant Soliven, AIF, and Daren Hardesty. In this segment we will cover: Imagine having all tax-deferred money and no plan to unwind it before you need it or are forced to take it, OR WORSE, the tax code changes, and it is not in your favor....

Financial planning with the end in mind. Part 1. 1152

Consider This Program with Aaron Rheaume, CKA, and Jamie Burton. In this segment we will cover: Many people think of gifting their assets once they have passed away, but what about when you still live? Find out the most efficient way to gift from your assets while you...

Financial Planning with the end in mind. Part 2. 1153

Consider This Program with Jamie Burton and Aaron Rheaume, CKA. In this segment we will cover: Many people think of gifting their assets once they have passed away, but what about when you still live? Find out the most efficient way to gift from your assets while you...

Can Social Security Benefits Help with Longevity Risk?

One of the questions we are often asked at Financial Enhancement Group is when should I/we take our Social Security benefits? In a serious but joking way, I generally respond with, “How long will you live?” It’s not a question anyone can answer with any certainty,...

The 5 Critical Elements of Financial Planning

James Clear, the author of “Atomic Habits,” always says, “Success is never dependent on one thing, but failure can be.” That has never been truer than with financial planning. When we talk about planning for retirement, the conversation usually goes in the same...

Are your investment choices late to the game? 1151

Consider This Program with Jamie Burton and Grant Soliven, AIF. In this segment we will cover: Are you late to the game? Many people continue to use mutual funds even though ETFs are far more efficient. On Consider This Program, we will explain what you need to be on...

Is Incremental Incapacitation Going to Affect You? with special guest Tom Hurley, J.D. 1150

Consider This Program with Jamie Burton and Grant Soliven, AIF. In this segment we will cover: Find out how to love and protect your future self and the ones you love with some brand-new strategies from the Financial Enhancement Group and Financial Enhancement Group...

Our 5 Critical Elements For Financial Planning – 1144

Consider This Program with Jamie Burton and Grant Soliven, AIF. In this segment we will cover: James Clear always says, "Success is never dependent on one thing, but failure can be!" Tune in to learn about the 5 Critical Elements that we have found lead to financial...

Is Uncle Sam A Bigger Factor Than Investment Losses – 1145

Consider This Program with Jamie Burton and Grant Soliven, AIF. In this segment we will cover: On this segment of Consider This Program, learn why the number one wealth eroding factor is not investment losses but Uncle Sam! Talking Points: 1. Tax Planning 2....

Kicking the Tax-Can Down the Road

If you could reduce your tax liability every year, wouldn’t the accumulation of those taxes add up to the smallest amount owed over your lifetime? In the short term, this is accurate, but it is the long-term ramifications that matter most. Wise investors need to...

Can Social Security Benefits Help with Longevity Risk?

One of the questions we are often asked at Financial Enhancement Group is when should I/we take our Social Security benefits? In a serious but joking way, I generally respond with, “How long will you live?” It’s not a question anyone can answer with any certainty,...

Social Security

It will be no surprise that most of us are tired of the supply chain issues causing delays. These delays stretch across nearly every industry, from foodservice to manufacturing and even into technology. However, despite the frustration this causes in our day-to-day...

Are you willing to risk half a million dollar on your retirement?

Consider This Program with Joe Clark, CFP, and Jamie Burton. In this segment we will cover: Description: When you elect to take Social Security can be one of the most significant financial decisions you will ever make. Most people fail to understand how the program...

Are you missing critical decisions that can wreck your retirement?

Consider This Program with Joe Clark, CFP, and Jamie Burton. In this segment we will cover: Description: Do you know the rules inside your company plan? Can you do an in-service non-hardship distribution? Do you have a Roth option? Do you have the age 55 rule? Do you...

Are You Hurting Your Beneficiaries By Leaving Them Gifts?

Consider This Program with Joe Clark, CFP, and Jamie Burton. In this segment we will cover: Description: You probably love your kids all the same, but even my brother and I, who appear very much alike, are very different individuals. Not all beneficiaries are the...

Are your life experiences going to cause you financial regrets?

Consider This Program with Joe Clark, CFP, and Jamie Burton. In this segment we will cover: Description: When you look at your investment and retirement accounts, why do you own what you own? How did you meet? How do you pivot, and how do you measure success? We will...

Is Social Security One Of Your Greatest Assets?

Consider This Program with Joe Clark, CFP, and Grant Soliven. In this segment we will cover: Deciding when to take Social Security can be one of the most costly decisions you make in retirement. Find out how Social Security timing can be an asset when figuring out...

How much are taxes actually costing you?

Consider This Program with Joe Clark, CFP, and Grant Soliven. In this segment we will cover: Knowing the difference between marginal and effective tax rates is important, especially going into retirement. Where do you need to focus your attention? Call 800-928-4001 or...

Do You Really Know What It Takes To Live?

Consider This Program with Joe Clark, CFP, and Grant Soliven. In this segment we will cover: Going into retirement, you have to have a clear picture of your standard of living. Join us as we discuss the best way to find out your true budget. Call 800-928-4001 or email...

Are your retirement assumptions misguided?

Consider This Program with Joe Clark, CFP, and Grant Soliven. In this segment we will cover: When planning for retirement, there are certain triggers or transitions that can push you closer to making a decision to leave the workforce. It is important to have a strong...

Real Rates = Real Change

We typically think of interest rates at their surface level or simply as the rate posted on a CD or treasury bond. Economists and professional investors will commonly refer to these as nominal rates. But real interest rates, or the nominal interest rate after...

Financial Resolutions

The new year is a time for setting intentions and hitting the ground running. Many people turn to losing weight, exercising more, or being more mindful when thinking of resolutions. But what about your finances? The beginning of the year is a great time to sit down...

Do you understand opportunity cost?

Consider This Program with Joe Clark, CFP, and Jamie Burton. In this segment we will cover: Every choice that you make has consequences, financial or otherwise. For example, if you choose apple pie over a brownie for dessert, you get the apple pie, but you give up the...

Why are annuities poor investment choices?

Consider This Program with Joe Clark, CFP, and Jamie Burton. In this segment we will cover: Annuities are usually marketed as safe investments, with guaranteed income when you're ready. Most buyers never see the truth. It's buried in huge, complex, jargon-filled...

Are mutual funds making you poor?

Consider This Program with Joe Clark, CFP, and Jamie Burton. In this segment we will cover: The underlying principle of mutual funds is brilliant, but there are multiple reasons we don't allocate any money to them. Schedule your complimentary Next Steps meeting today!...

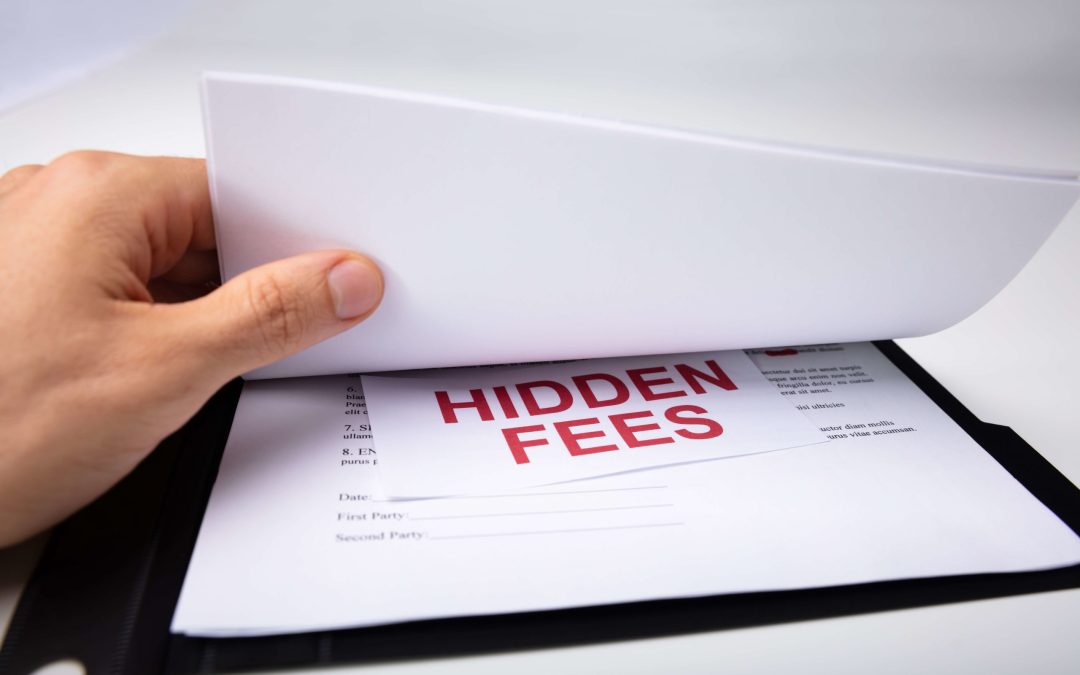

What is hiding in your financial plan?

Overpaying fees and expenses is an area of investing that require dedicated focus. Twice last year, our firm changed ETF providers due to cost versus benefit. The reduction of fees does not guarantee outstanding performance, but unwarranted or necessary fees and...

How can you determine your financial health? 1121

Consider This Program with Joe Clark, CFP and Jamie Burton. In this segment we will cover: Description: Financial Health and Financial Literacy are two different things. How can you determine if you are financially healthy? Call 800-928-4001 or email us at...

What does fading away mean for you, your family, and your legacy. -1120

Consider This Program with Joe Clark, CFP and Jamie Burton. In this segment we will cover: Description: 10% of us die….the other 90% fade away. It is likely your estate planning documents have the same challenges that mine did. What should you consider, and what are...

Why do we consider Health Savings Accounts pure gold? – 1118

Consider This Program with Joe Clark, CFP and Jamie Burton. In this segment we will cover: Description: Assets – stocks, bonds, and cash – behave differently and have different jobs. The same is true of tax treatment. There is tax-deferred, taxable, Ira, Roth, 401k,...

Your health and your finances – 1119

Consider This Program with Joe Clark, CFP and Jamie Burton. In this segment we will cover: The saying goes, “An ounce of prevention is worth a pound of cure.” It’s true! Investing in your health is wise from a perspective of living longer and good for your billfold....

New Year, New Habits

Change happens all the time - different routines affect people emotionally, financially, and often relationally. Retirement is one of those times. Whether leaving the workforce was your own choice or a result of outside circumstances, it can cause stress with your...

How to turn financial catastrophes into inconveniences. – Episode 1074

Consider This Program with Joe Clark, CFP and Daren Hardesty. In this segment we will cover: Is there a simple way to turn disasters into inconveniences with your personal finance? There are several options, and it could be different depending on your financial phase...

Prepare For Cognitive Decline – Episode 1073

Consider This Program with Joe Clark, CFP, and Daren Hardesty. In this segment we will cover: Most estate documents lay out the plan for what happens when you die – how can you make sure your wishes are maintained when you are cognitively declining? Do you need formal...

Financially dangerous: getting into a routine.- Episode 1075

Consider This Program with Joe Clark, CFP, and Daren Hardesty. In this segment we will cover: There is a lot of confusion between risk and routine. Many do not realize that getting into a routine can be financially dangerous. Things that made sense in the past do not...

Don’t Just Plan For The Metaphorical Hit By A Bus – Fading Away

Consider This Program with Joe Clark, CFP, and Daren Hardesty. In this segment we will cover: It isn't easy talking about death. But it is even harder talking about fading away. Having proper estate documents and planning is key to leaving a legacy, but it is more...

‘Tis the Season for Giving

Did you know two tax codes exist? Most people will tell you one is for the rich and one is for the poor. That is not true. The real answer is there is one for the informed and one for the uninformed. At the Financial Enhancement Group, we take pride in our ability to...

The retirement tip that no one is talking about!

One of the most significant hurdles to overcome if retiring before age 65 is health insurance costs. It is expensive and can break your retirement budget before qualifying for Medicare. What if I told you the cost of health insurance might have been drastically...

It Is Never Too Early For Legacy Planning, But It Can Be Too Late!

Consider This Program with Joe Clark, CFP and Daren Hardesty. In this segment we will cover: Leaving a legacy is important to many families. However, taking the time and energy to make sure you and your family are taken care of isn't easy to set aside. Unfortunately,...

Can You Afford To Live Until You Are 100?

Consider This Program with Joe Clark, CFP and Daren Hardesty. In this segment we will cover: The age-old question, what happens if I live too long? It can be a risk factor, but good news. We can plan for this ahead of time. Find out how the retirement V for victory...

Should You Age At Home?

Consider This Program with Joe Clark, CFP, and Daren Hardesty. In this segment we will cover: Your options change as you age, but the good news is you don't have to do it alone! From retirement communities to co-habiting to long-term care facilities, there are...